What Does Card Compromise Mean?

You may have received a letter or phone call from SCCU stating your debit card/credit card has been compromised. Wait, What??? My card has been compromised? What does that even mean?

Receiving a letter that your debit card/credit card has been “compromised” can be upsetting and confusing, to say the least. Unfortunately, plastic card fraud is on the rise.

A compromised card notification does not mean any fraudulent activity occurred on your account. By notifying you, Soo Co-op Credit Union is taking every precaution to ensure your account data is handled with the highest level of safety and security.

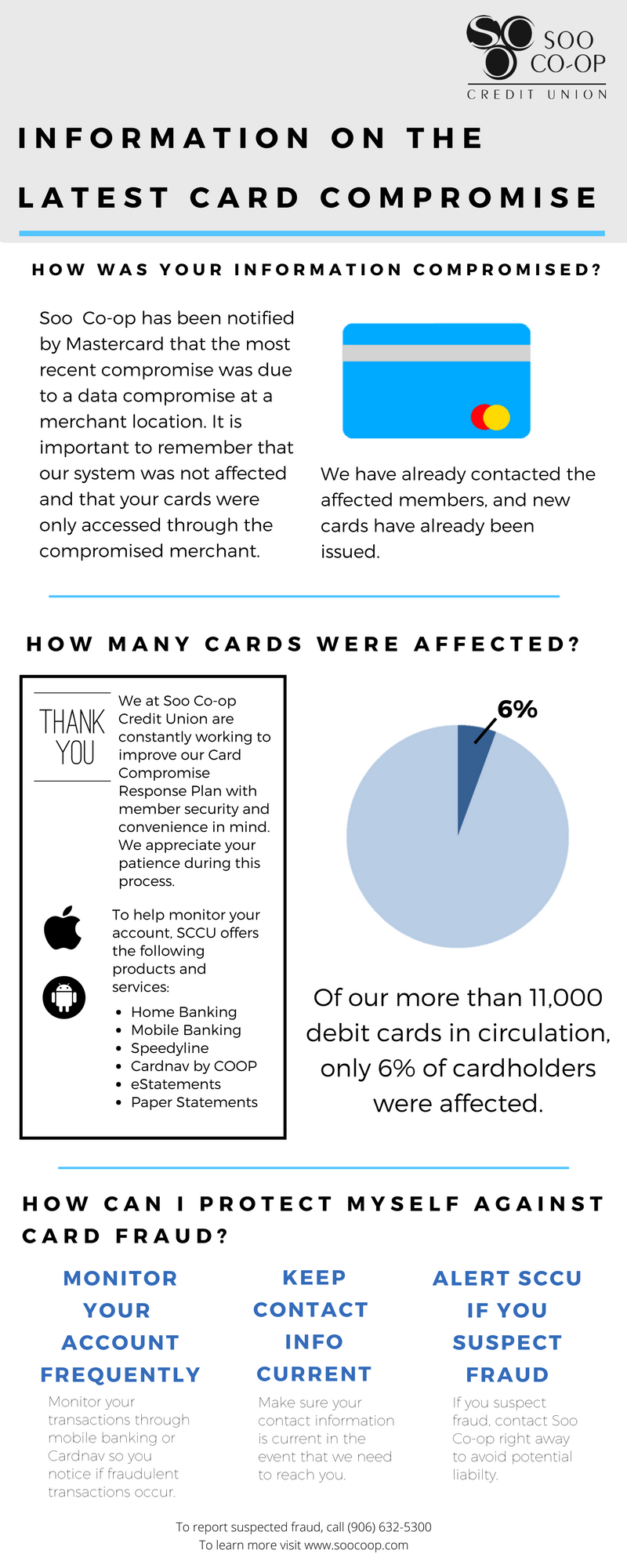

By definition, A compromised debit /credit card means that information (e.g., card number, name) may have been obtained by an unauthorized source. It does not mean that Soo Co-op Credit Union’s systems were compromised. In most cases, the breach occurs at a location that accepts or processes card transactions (e.g., merchant terminals, transaction processors, or phishing).

Some considerations

If Soo Co-op Credit Union receives a report that your debit/credit card information is compromised, we will take every step to ensure the security of your debit/credit card. In most cases, we will reissue your card with a different number. In addition to the new card, we will send you a new pin, and a letter explaining the steps you will need to take once you receive your new debit card.

Here are some additional considerations:

- Soo Co-op Credit Union is not given any details on where the compromise occurred.

- Not all cards on an account may be impacted, as each member has a unique card number.

- If you have automatic debits set up for that particular card number, you will need to contact the payees and provide the new debit card number and expiration date.

Soo Co-op Credit Union strives to offer you safe and secure financial service solutions. In particular, we monitor account activity, identify trends, work to reduce or restrict activity, and reissue cards, when needed.

As a reminder, if you ever suspect fraudulent activity on your debit/credit card, please call (906) 632-5300 during credit union regular business hours.